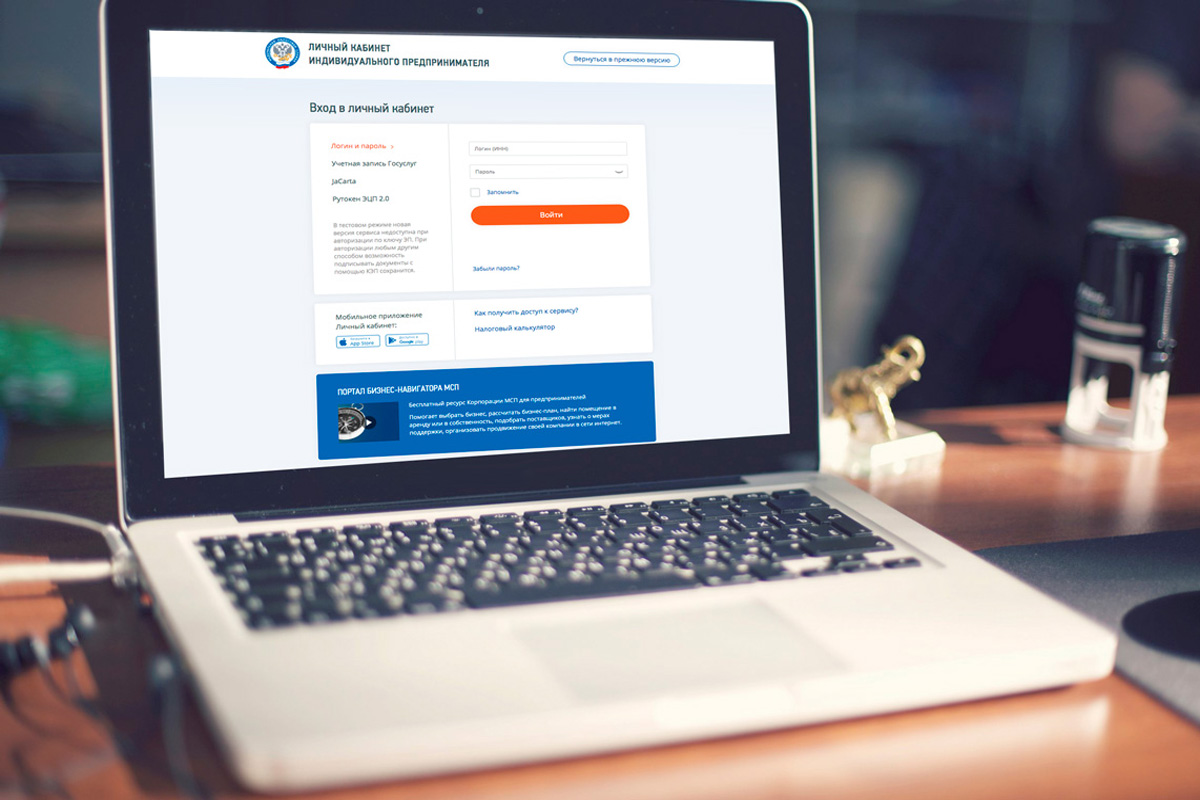

Individual entrepreneurs can submit reports through the Personal account of the individual entrepreneur taxpayer

Starting from April 1, 20 forms of tax and accounting statements can be sent to the Internet service "Personal account of the taxpayer of an individual entrepreneur".

This became possible due to the entry into force of paragraph 3 of Article 1 of Federal Law No. 389-FZ dated 07/31/2023 "On Amendments to Parts One and Two of the Tax Code of the Russian Federation, Certain Legislative Acts of the Russian Federation and on the suspension of the second paragraph of paragraph 1 of Article 78 of Part One of the Tax Code of the Russian Federation".

You can generate these reports for free in the Taxpayer Legal program, after which you must sign with a qualified electronic signature and send the file.XML via LC IP. You can find out how to get a CAP here.

LC IP users will be able to track the status of a desk tax audit with the possibility of receiving and then downloading all documents provided for by electronic document management with tax authorities confirming the sending of a tax return to the tax authority and the result of its processing.

The following reporting forms are available for sending via LC IP:

- declaration on tax paid in connection with the application of the simplified taxation system (CND 1152017);

- declaration for the extraction of minerals (CND 1151054);

- information on the permits received for the extraction (catch) of aquatic biological resources, the amounts of the fee for the use of aquatic biological resources, payable in the form of one-time and regular contributions (CND 1110011);

- tax declaration on excise taxes on tobacco (tobacco products), tobacco products, electronic nicotine delivery systems and liquids for electronic nicotine delivery systems (CND 1151074);

- tax declaration on excise taxes on automobile gasoline, diesel fuel, engine oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, medium distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, passenger cars and motorcycles (CND 1151089);

- tax declaration on excise taxes on ethyl alcohol, alcoholic and (or) excisable alcohol-containing products, as well as on grapes (KND 1151090);

- tax calculation of the amounts of income paid to foreign organizations and the amounts of taxes withheld (CND 1151056);

- tax declaration on the unified agricultural tax (CND 1151059);

- personal income tax return (3-personal income tax) (CND 1151020);

- information on the licenses (permits) received for the use of wildlife objects, the amounts of the fee for the use of wildlife objects to be paid, and the amounts of the fee actually paid (CND 1110022);

- water tax return (CND 1151072);

- unified (simplified) tax return (CND 1151085);

- information on the number of objects of aquatic biological resources to be removed from their habitat as permitted by-catch, based on a permit for the extraction (catch) of aquatic biological resources and the amounts of the fee to be paid in the form of a one-time contribution (CND 1110022);

- tax declaration on indirect taxes (value added tax and excise taxes) on the import of goods into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union (CND 1151088);

- calculation of the amount of the recycling fee in respect of wheeled vehicles (chassis) and (or) trailers to them (KND 1151091);

- calculation of the amount of the recycling fee for self-propelled vehicles and (or) trailers to them (KND 1151101);

- personalized information about individuals (CND 1151162);

- calculation of regular payments for the use of mineral resources (CND 1151026);

- calculation of personal income tax amounts calculated and withheld by a tax agent (Form 6-Personal income tax) (CND 1151100);

- calculation of insurance premiums (CND 1151111).

*Support for entrepreneurs in the region is carried out within the framework of the national project "Small and medium-sized entrepreneurship and support for individual entrepreneurial initiative", which was initiated by the President and overseen by First Deputy Prime Minister Andrei Belousov.